How To Read Your Tax Bill

Treasurer

How to Read Your Tax Bill

(Hover over the tool tips to get more information)

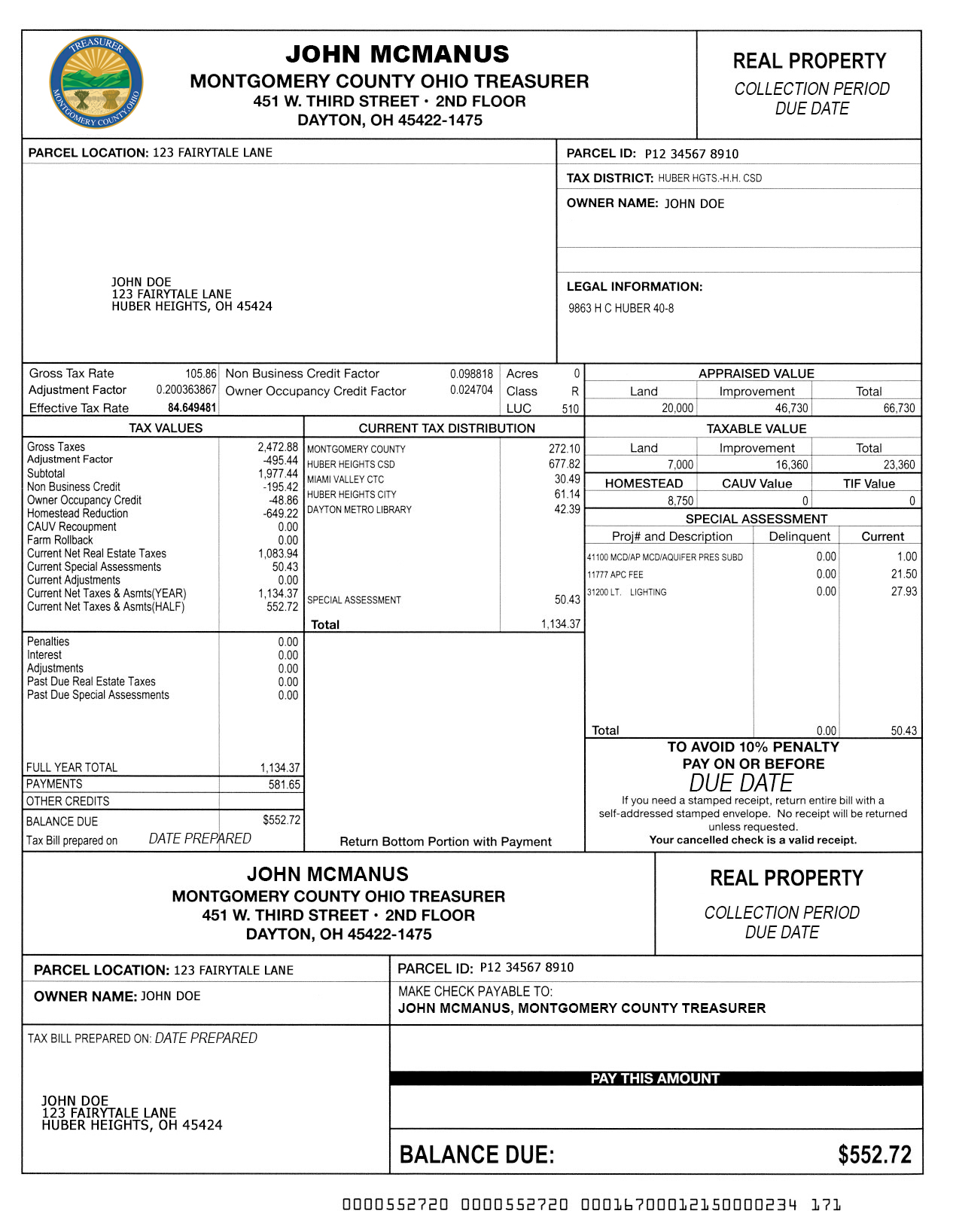

PARCEL LOCATION

- LOCATION OF THE PARCEL (PROPERTY).

PARCEL ID

- A NUMBER ASSIGNED TO EACH PARCEL OF LAND RELATED TO THE REAL ESTATE PLAT BOOKS LOCATED IN THE AUDITOR’S OFFICE.

- R72 00000 000

A. THE FIRST THREE OR FOUR DIGITS IDENTIFTY THE TAXING DISTRICT.

B. THE NEXT THREE DIGITS CORRESPOND TO A PLAT BOOK NUMBER IN THAT DISTRICT.

C. THE NEXT TWO OR THREE DIGITS CORRESPOND TO THE PAGE NUMBER IN THE BOOK.

D. THE FINAL FOUR DIGITS CORRESPOND TO THE INDEX NUMBER ON THE PAGE.

TAX DISTRICT

- THE TAXING DISTRICT IN WHICH THE PARCEL IS LOCATED (CURRENTLY 93 SEPARATE TAXING DISTRICTS IN MONTGOMERY COUNTY).

OWNER NAME

- WILL LIST UP TO TWO NAMES ON A DEED – IF MORE THAN TWO NAMES ARE ON A DEED, THE BILL WILL INCLUDE THE FIRST NAME LISTED ON THE DEED AND “ET AL” (MEANING “AND OTHERS”).

LEGAL INFORMATION

- THE LOT NUMBER OR SECTION, TOWN, AND RANGE NUMBER OF THE PARCEL.

APPRAISED VALUE

- THE MARKET VALUE OF PROPERTY FOR TAX PURPOSES (TOTAL OF LAND AND IMPROVEMENT). THIS IS DETERMINED BY APPRAISALS/REAPPRAISALS DONE BY THE COUNTY AUDITOR ONCE EVERY SIX YEARS. VALUE UPDATES ARE MADE IN THE THIRD YEAR FOLLOWING REAPPRAISAL.

TAXABLE VALUE

- IN OHIO, PROPERTY TAXES ARE LEVIED AGAINST THE ASSESSED VALUE OR 35% OF THE APPRAISED VALUE OF THE PROPERTY.

HOMESTEAD

- PROPERTY TAX EXEMPTION FOR APPLICANTS WHO OWN AND OCCUPY THEIR HOME AT THEIR PRIMARY PLACE OF RESIDENCE AS OF JANUARY 1 OF THE YEAR IN WHICH AN APPLICATOIN IS FILED, AND APPLICANT AND SPOUSE’S TOTAL INCOME DOES NOT EXCEED THE AMOUNT SET BY STATE LAW, AND APPLICANT MEETS ONE OF THE ADDITIONAL CRITERIA: 1) AT LEAST 65 YEARS OF AGE DURING THE YEAR YOU FIRST APPLY, OR 2) ARE DERTERMINED TO BE PERMANENTLY AND TOTALLY DISABLED, OR 3) ARE A SURVIVING SPOUSE (AT LEAST 59 YEARS OF AGE ON DATE OF DECEDENT’S DEATH) OF A HOMESTEAD RECIPEINT IN THE YEAR OF HIS/HER DEATH.

CAUV VALUE (COMMON AGRICULTURAL USE VALUE)

- UNDER THE CAUV PROGRAM, FARMLAND IS VALUED BASED ON SOIL TYPES RATHAN THE “BEST AND HIGHEST USE”. TO ESTABLISH VALUATION, SOIL SURVEYS ARE CONDUCTED TO DETERMINE VARIOUS SOIL TYPES AND THE AMOUNT OF ACREAGE OF PARTICULAR SOIL TYPES. EACH SOIL TYPE HAS A PRE-ASSIGNED VALUE SET BY THE STATE. THE CAUV PROGRAM DOES NOT REDUCE THE VALUATION OF BUILDINGS OR THE MINIMUM ONE-ACRE HOMESITE THAT LIES BENEATH THE BULDINGS.

TIF VALUE

- TAXABLE (35%) TAX INCREMENT FINANCING (TIF) VALUE USED TO CALCULATE TIF AMOUNT UNDER SPECIAL ASSESSMENTS. ALL TIF PAYMENTS ARE THEN DISTRIBUTED BACK TO THE MUNICIPALITY.

SPECIAL ASSESSMENT

- CHARGES ADDED BY TAXING DISTRICT FOR SUCH ITEMS AS STREET LIGHTING, CURBS, SIDEWALK IMPROVEMENTS, ETC.

GROSS TAX RATE

- GROSS TAX RATE OF THE TAXING DISTRICT.

ADJUSTMENT FACTOR

- MAINTAINS THE EXISTING LEVEL OF TAXES PAID ON VOTED MILLAGE. THE TAXING DISTRICT COLLECTS THE SAME AMOUNT OF REVENUE THAT WAS VOTED REGARDLESS OF INCREASED PROPERTY VALUES, EXCEPT FOR ADDED VALUE FROM NEW CONSTRUCTION.

EFFECTIVE TAX RATE

- GROSS TAX RATE LESS GROSS TAX RATE MULTIPLIED BY REDUCTION FACTOR.

NON BUSINESS CREDIT

- CREDIT FOR AGRICULTURAL AND RESIDENTIAL PARCELS THAT APPLIES ONLY TO TAX LEVIES PASSED OR IN EXISTENCE PRIOR TO THE NOVEMBER 2013 ELECTION. THE CREDIT DOES NOT APPLY TO COMMERCIAL AND INDUSTRIAL PARCELS.

OWNER OCCUPANCY CREDIT

- TAX REDUCTION PROGRAM FOR OWNER-OCCUPIED RESIDENTIAL PROPERTY IN OHIO THAT APPLIES ONLY TO TAX LEVIES PASSED OR IN EXISTENCE PRIOR TO THE NOVEMBER 2013 ELECTION.

ACRES

- SIZE OF THE PARCEL.

CLASS

- CLASSIFICATION (RESIDENTIAL, AGRICULTURAL, COMMERCIAL, INDUSTRIAL) ASSIGNED TO THE PARCEL BY THE AUDITOR’S OFFICE.

LUC

- LAND USE CODE

NON BUSINESS CREDIT

- CREDIT FOR AGRICULTURAL AND RESIDENTIAL PARCELS THAT APPLIES ONLY TO TAX LEVIES PASSED OR IN EXISTENCE PRIOR TO THE NOVEMBER 2013 ELECTION. THE CREDIT DOES NOT APPLY TO COMMERCIAL AND INDUSTRIAL PARCELS.

OWNER OCCUPANCY CREDIT

- TAX REDUCTION PROGRAM FOR OWNER-OCCUPIED RESIDENTIAL PROPERTY IN OHIO THAT APPLIES ONLY TO TAX LEVIES PASSED OR IN EXISTENCE PRIOR TO THE NOVEMBER 2013 ELECTION.

HOMESTEAD REDUCTION (CREDIT)

- DETERMINED BY MULTIPLYING THE TOTAL HOMESTEAD REDUCTION VALUE BY THE EFFECTIVE TAX RATE BY 1 MINUS (THE SUM OF THE NON-BUSINESS CREDIT FACTOR AND THE OWNER OCCUPANCY CREDIT FACTOR)

COMMON AGRICULTURAL USE VALUE (CAUV) RECOUPMENT

- IF FARMLAND ENROLLED IN THE CAUV PROGRAM IS CONVERTED TO NON-AGRICULTURAL USE, A RECOUPMENT OF THE SAVINGS RECEIVED THROUGH THE CAUV PROGRAM FROM THE PREVIOUS THREE YEARS MUST BE REPAID. FAILURE OF A NEW OWNER TO APPLY FOR CAUV OR A RENEWAL OF AN EXISTING CAUV CAN TRIGGER THE RECOUPMENT PROCESS.

FARM ROLLBACK

- CREDIT CALCULATED FROM PARTICIPATION IN CAUV PROGRAM.

CURRENT NET REAL ESTATE TAXES

- CURRENT NET TAXES LESS REDUCTION FACTOR CREDIT, NON BUSINESS CREDIT, OWNER OCCUPANCY CREDIT, AND HOMESTEAD REDUCTION CREDIT.

CURRENT SPECIAL ASSESSMENTS

- CHARGES ADDED BY TAXING DISTRICT FOR SUCH ITEMS AS STREET LIGHTING, CURBS, SIDEWALK IMPROVEMENTS, ETC.

CURRENT ADJUSTMENTS

- REPRESENTS ANY CHANGES BEING CALCULATED ON THE BILL AFTER THE ORIGINAL CALCULATION OF CHARGES.

CURRENT NET TAXES & ASMTS (YEAR)

- TOTAL OF CURRENT NET TAXES & CURRENT ASSESSMENTS FOR FIRST AND SECOND HALF TAX YEAR.

CURRENT NET TAXES & ASMTS (HALF)

- TOTAL OF CURRENT NEXT TAXES & CURRENT ASSESSMENTS FOR FIRST HALF TAX YEAR.

PENALTIES

- PENALTIES CHARGED FOR LATE PAYMENT OF CURRENT AND DELINQUENT TAXES AND ASSESSMENTS.

INTEREST

- INTEREST CHARGED ON ALL PREVIOUS YEAR UNPAID TAXES (APPLIED AUGUST 1) AND INTEREST CHARGED ON CURRENT YEAR AND ALL PREVIOUS YEAR UNPAID TAXES (APPLIED DECEMBER 1). PER OHIO REVISED CODE (SECTION 323.121)

ADJUSTMENTS

- REPRESENTS CHARGES TO PRIOR TAX YEARS APPEARING ON THE CURRENT TAX BILL.

PAST DUE REAL ESTATE TAXES

- DELINQUENT REAL ESTATE CHARGES PRIOR TO CURRENT COLLECTION PERIOD. IF PRIOR COLLECTION PERIOD ENDED WITH TAXES UNPAID, THEY WILL APPEAR AS DELINQUENT ON THE NEXT BILLING EVEN IF PAYMENT IS MADE.

PAST DUE SPECIAL ASSESSMENTS

- TOTAL DELINQUENT ASSESSMENTS PRIOR TO CURRENT COLLECTION PERIOD. IF PRIOR COLLECTION PERIOD ENDED WITH ASSESSMENTS UNPAID, THEY WILL APPEAR AS DELINQUENT ON THE NEXT BILLING EVEN IF PAYMENT IS MADE.

TAX BILL PREPARED ON

- DATE TAX BILL WAS PRINTED.

CURRENT TAX DISTRIBUTION

- DISTRIBUTION BREAKDOWN OF CURRENT NET TAXES & SPECIAL ASSESSMENTS.

SPECIAL ASSESSMENT

- CHARGES ADDED BY TAXING DISTRICT FOR SUCH ITEMS AS STREET LIGHTING, CURBS, SIDEWALK IMPROVEMENTS, ETC.